LAWYERS DRAFTING REGULATIONS

It's refreshing to have an administration bent on bringing change in the form of regulation to the markets. Unfortunately the outcome of most encounters are starting to show wear and tear. The fox has left the barn, guys! Law firms and lobby groups in Washington must be having a record year! With so many new regulations coming out, we are surprised only a few SEC agents have been caught doing insider trading!

TIME TO TALLY

We have winners and we have losers...

FOR NOW

Winners have been large banks supported by taxpayers on a global scale. Unfortunately this is a shell game and until assets start to transact and deals get done, balance sheets are just illusions.

The biggest losers are by far foreign holders of US bonds. They just have been destroyed in the last month and we predicted that at one point the rest would follow. Unfortunately, the massive injection of liquidity is not having the results hoped for. While banks are winning on the spread game, everybody else is losing out.

Conventional market knee jerk reaction of flight to safety from out of stock to the relative SAFETY of bonds has NOT OCCURRED. We said this would eventually happen. IT took six months longer but we have defeated valiant efforts by Chairman Bernanke and Secretary Geithner. BOTH Equity and bonds markets fell this week. Gold rallied.

THE TYPE OF NEWS TO EXPECT THE NEXT SIX MONTHS

Bbg - Kokusai Cuts Treasuries as Fukoku Sees End to Rally

May 21 (Bloomberg) -- Bond investors in Japan from Kokusai Global Sovereign Open Fund to Fukoku Mutual Life Insurance Co. are trimming their holdings of U.S. Treasuries, betting that the biggest slump in U.S. debt in 15 years will likely continue.

Kokusai Global Sovereign, Asia’s largest bond fund, reduced its bet on long-term Treasuries in March, while Nippon Life Insurance Co., Japan’s biggest life insurer, plans to focus its new purchases on yen-denominated debt, it said last month. Fukoku Mutual says it will buy yen bonds because a 10-year rally in U.S. debt will end this year.

THE PATIENT IS NOT RESPONDING

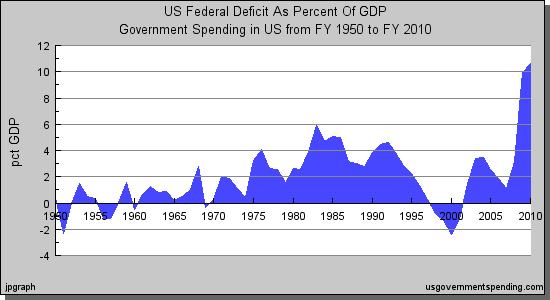

We suspect that the market which lost an aggregate of $50TB in value from July 2007 to March 9,2009 isn't really well served by the $13TB thrown at the problem by global leaders.

Unfortunately, the cost of capital is rising, deals are not getting done because banks are requiring more equity for transactions to occur and the process seems bogged down.

WHAT TO EXPECT

On the upcoming short week, it will become a more pressing matter to see what financial reporters decide "what" is news.

CALIFORNIA

We suspect that California's finances will come front and center and from there the markets will take their cues.

KEEP AWAY FROM THE US DOLLAR

In any case, the odds of the S&P going to 1k seem diminished while those of the US 10yr hitting 3.50% are now but a foregone conclusion.

As Recently as two weeks ago, pundits were suggesting that the US was going to lead the world out of recession, but the recent destruction of the USD suggest, that investors may be more keen to looking to China and other creditor nations as safer harbors in these troubled times.

Good trading to you.

DCW