The end is near my friends.

Greed makes market Frothy.

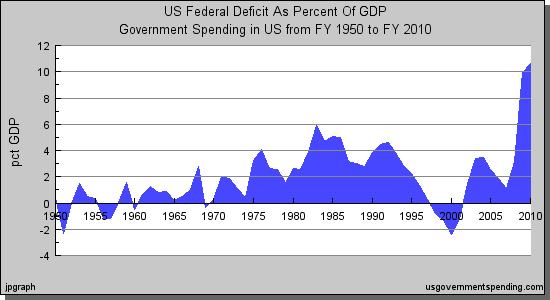

With the Yankee dollar down 35% in less than two years, record deficits, demagoguery rampant in the media and to top it all, a furry of speculators chasing the illusive buck.

How many laidoff works are opening these accounts at discount brokerages?

What is their average net worth profile?

Are they using saved up or severance money to speculate?

With 7MM newly unemployed Americans, Wall Street has the dubious disctintion of having laid off only 8% of its work force. The latter remains unscathed and the concentration of power nearly tripling to the whim of the Fed and the Treasury department.

In this electronic age, we now have Click power and the stock market has become the latest casino. You don't have to tip anyone, go into security lines to get to Vegas and you can trade from the comfort of your skeevies.

The economic numbers do not support such idiotic speculation and at this rate of Government Propaganda, President Obama is going to have to move into Air Force One to make it to his next motivational speech on time.

STRATEGY

Sold all US banks, kept MSFT and INTC

Best to buy gold and have it delivered to your safety deposit box...

We might not trade in the same attire but we are starting to bet against this with December S&P puts (20% done) up to a full 100% position by October 14th

Dollar parity coming soon!

Tuesday, September 15, 2009

Tuesday, September 1, 2009

Not betting against the Fed in September... S&P 1150 in reach

September prior to Labor day. The month of Nostalgia.

The beaches of the French and Italian Rivieras have emptied. The crews of the Mega Yachts can relax because their owners have returned to their business headquarters. Mothers have prepared their kids for school and a slew of summer data is coming out.

We had predicted that inventories would be run bare back from Q4 2008 and that at some point in 2009 there would be a rally based on a "replenishment quarter". It's easier to get a banker to extend credit when orders are piling up rather than have them finance shaky receivables...

This is happening more or less on schedule.

VALUATION

The problem is as we look into 2010, we are convinced that the "economic engine" is going to run at a discount to 2007 numbers. Some industries and retailers will have to contend with the credit crunch or should we call it "normal credit lines return to market" .

Down the line it will create valuation issues. Should you pay the SAME dollar for a stock that produces LESS top line revenue/ Profit?

Right now 93% of S&P 500 companies (SPX) are running over their 50 day moving average. Isn't that pure speculation?

So if the SPX is relatively safe, the really BIG worry is in the private cos and mom and pops store which will take the brunt of the credit crunch. Those stories will be hard felt in many rural communities fall but they rarely make it in the press or the blogs.

TIMING

Coming back to listed equities, be mindful that other skeptical Money Managers have stayed partially on the sidelines ( high cash component) and that their jobs are on the line if they don't get in to secure a bonus. We think September will see great institutional speculation based on fear rather than on exuberant retail demand. Once those Money managers secure their benchmark bonuses, they will unload. There fore expect higher volatility as well as higher volumes as fall progresses.

The underlying rationale for an October-Mid November correction then makes sense.

While there continues to be a witch hunt against short sellers, they should prevail when sanity returns.

In the meantime with Citi above $5, Ford below $8, Oil between $65-$73, Gold above $950, UST 10yr at 3.38%, Bernanke and Geithner seems to hold the markets for an upside September.

In October we can talk deficits , national debt and see if investors are ready to run for the exits...

Good trading to you

DCW

The beaches of the French and Italian Rivieras have emptied. The crews of the Mega Yachts can relax because their owners have returned to their business headquarters. Mothers have prepared their kids for school and a slew of summer data is coming out.

We had predicted that inventories would be run bare back from Q4 2008 and that at some point in 2009 there would be a rally based on a "replenishment quarter". It's easier to get a banker to extend credit when orders are piling up rather than have them finance shaky receivables...

This is happening more or less on schedule.

VALUATION

The problem is as we look into 2010, we are convinced that the "economic engine" is going to run at a discount to 2007 numbers. Some industries and retailers will have to contend with the credit crunch or should we call it "normal credit lines return to market" .

Down the line it will create valuation issues. Should you pay the SAME dollar for a stock that produces LESS top line revenue/ Profit?

Right now 93% of S&P 500 companies (SPX) are running over their 50 day moving average. Isn't that pure speculation?

So if the SPX is relatively safe, the really BIG worry is in the private cos and mom and pops store which will take the brunt of the credit crunch. Those stories will be hard felt in many rural communities fall but they rarely make it in the press or the blogs.

TIMING

Coming back to listed equities, be mindful that other skeptical Money Managers have stayed partially on the sidelines ( high cash component) and that their jobs are on the line if they don't get in to secure a bonus. We think September will see great institutional speculation based on fear rather than on exuberant retail demand. Once those Money managers secure their benchmark bonuses, they will unload. There fore expect higher volatility as well as higher volumes as fall progresses.

The underlying rationale for an October-Mid November correction then makes sense.

While there continues to be a witch hunt against short sellers, they should prevail when sanity returns.

In the meantime with Citi above $5, Ford below $8, Oil between $65-$73, Gold above $950, UST 10yr at 3.38%, Bernanke and Geithner seems to hold the markets for an upside September.

In October we can talk deficits , national debt and see if investors are ready to run for the exits...

Good trading to you

DCW

Subscribe to:

Posts (Atom)