Wednesday, January 27, 2010

Friday, January 22, 2010

Bernanke and other thoughts

Since WWII, it was the likes of Truman and Ike, the Kennedys with the Pentagon that ran the order of things and kept the country "safe" from the red menace.With the fall of the wall, Reaganomics were hailed as liberation and deregulation created its raison d'être. Clinton was the beneficiary of feel good years and money plowed into entitlements and the money agencies

The problems started when the NAZ bubble busted and the phlegmaticChairman Greenspan pontificating that cheap money combined with a deregulated bigger is better banking model could and would solve all ills. What followed was Wall Street greed at its worst... Another talker he was that Greenspan. Instead of Volkerizing the players, he chastised wiht empty words while relying on abnormally low rates. Ho, what the great guru he was. Creating a real estate bubble to eclipse all bubbles prior to it and leaving his successor to a bubble to supersede our wildest expectations. I will never forget Greenspan visiting the senate fiance committe hearings. He would show poise. He would reason and blab his musings to Congressmen more interested in their TV face time than meaningful queries. Using a muddled discourse pretty lean on sound bites if it weren't the exception of "Market exuberance", the Chairman spend more time explaining the actions rather than restraining the new leverage addicts.A FED chairman should be like a plumber. FIRST, he fixes the flood and then he tells who to prevent the next one.

So after the wheels came off in 2008, with a lot of finger pointing, useless commissions, printing money and a President who talks CHANGE but can`t change a tire without a 12,000 page bill , the question begs: who WILL take up the baton? the Leftists? Give me a break! I doubt Obama's Democrats will get a second term short of an atomic bomb exploding in Texas Stadium. 10% unemployment gives a lot of people time to hold other people accountable for their own lack of political activism.

WHAT THE FUTURE PROMISES

Push your timeline of future events towards 2012, and ask:

- "WHAT US political agenda will carry the day?"

If anything, we think SMALLER government will be the campaign slogan after vilified bankers will have been emasculated by legislation that comes BACK 25 years too late. Negative campaigns don't work...

- " WHO can run on a ticket of smaller government and show a portfolio of lean management?

That's the candidate the republicans will push

- " WHEN?"

With the Supreme court lifting campaign contribution limits, this is going to be great times for Media assuming they are reaching a wired world... Look for ads to pop on your smart phone soon enough. Candidates will come through in the fall of 2010 to build on this predicted jobless recovery...

-"HOW do you make money?"

Follow the money ... the reason why the US dollar is rallying against the Euro and even fiercer socialist rhetoric is in part due to SMART people having already priced in an end to Iraq involvement and a leaner form of government. What are Hutchinson, Power Corp, Buffett or Carlos Slim buying... sure wasn't real estate in 2006... but brand names , distribution, railways (i.e. coal), Newspapers.

Just like the market always think 5 months ahead, all the billionaires I read about have 5-7 years horizons for their plans in the form of buying and selling assets ... that is what killed GE's shareholders... lack of focus on thinking on what would happen in 2012 back in 2006. Instead they hope to grow the business, to increase the dividend and other nonsense...... the older generation would have bailed on the finance arm way before it took over the shop... meantime real estate looks like the play in 2012!

THE TRICKY PART: American Industry must now embark on a "peace" dividend and spend it on infrastructure and technology but they are held back by, of all things. the health care bill was meant to fix the costs of labor along a viable rate not an exponential curve. CEOs might be scratching their heads on trying to grow their top line revenue for the next shareholders meeting but if they really were any good at their jobs they would TRY to fix health care

Why trust the US as a place of business when health care costs and litigation derail business decisions in favor of China, Brazil? or anywhere for that matter? Any businessman worth his stock options will tell you: " not a good idea to go into a 5 year program where government rhetoric can impede rather than help minimize let alone quantify risk.

I believe it is a mistake on the part of the Republicans to partisan the debate and block health care reform... the sooner it passes the beter the dividend by the time they come to power in 2012. By 2015 you will read biographies where Republican congressional leaders will look back at 2009 and say THAT was the time to pass legislation. Now money talks in Washington not intelligent debate.

In the meantime, next week the ever frequent US Treasuries notes auction is coming to gauge the market appetite. Let's hope the Wall Street fat cats don't use the opportunity to show their displeasure with the Obama tactics to feed them to popular anger...

Now you may be asking yourselves , been reading this rant for 5 minutes, where is Bernanke in all of this? He 's the desert my friends! With a stalling reappointment vote

delayed in Congress, he may become the poor sacrificial goat to appease all the disgruntled. Quite unlikely for TIME's man of the year but HOW much fun it is to think of all the possible candidates... A good and true disciple of von Mises would be too much to ask for but I'd rather fall asleep on the thought of an appointment of an Austrian school economist rather than those awful choices rampant these days!

Enjoy your weekend and hope you have some cash stashed aside ... you might need it sooner than you think!

The problems started when the NAZ bubble busted and the phlegmaticChairman Greenspan pontificating that cheap money combined with a deregulated bigger is better banking model could and would solve all ills. What followed was Wall Street greed at its worst... Another talker he was that Greenspan. Instead of Volkerizing the players, he chastised wiht empty words while relying on abnormally low rates. Ho, what the great guru he was. Creating a real estate bubble to eclipse all bubbles prior to it and leaving his successor to a bubble to supersede our wildest expectations. I will never forget Greenspan visiting the senate fiance committe hearings. He would show poise. He would reason and blab his musings to Congressmen more interested in their TV face time than meaningful queries. Using a muddled discourse pretty lean on sound bites if it weren't the exception of "Market exuberance", the Chairman spend more time explaining the actions rather than restraining the new leverage addicts.A FED chairman should be like a plumber. FIRST, he fixes the flood and then he tells who to prevent the next one.

So after the wheels came off in 2008, with a lot of finger pointing, useless commissions, printing money and a President who talks CHANGE but can`t change a tire without a 12,000 page bill , the question begs: who WILL take up the baton? the Leftists? Give me a break! I doubt Obama's Democrats will get a second term short of an atomic bomb exploding in Texas Stadium. 10% unemployment gives a lot of people time to hold other people accountable for their own lack of political activism.

WHAT THE FUTURE PROMISES

Push your timeline of future events towards 2012, and ask:

- "WHAT US political agenda will carry the day?"

If anything, we think SMALLER government will be the campaign slogan after vilified bankers will have been emasculated by legislation that comes BACK 25 years too late. Negative campaigns don't work...

- " WHO can run on a ticket of smaller government and show a portfolio of lean management?

That's the candidate the republicans will push

- " WHEN?"

With the Supreme court lifting campaign contribution limits, this is going to be great times for Media assuming they are reaching a wired world... Look for ads to pop on your smart phone soon enough. Candidates will come through in the fall of 2010 to build on this predicted jobless recovery...

-"HOW do you make money?"

Follow the money ... the reason why the US dollar is rallying against the Euro and even fiercer socialist rhetoric is in part due to SMART people having already priced in an end to Iraq involvement and a leaner form of government. What are Hutchinson, Power Corp, Buffett or Carlos Slim buying... sure wasn't real estate in 2006... but brand names , distribution, railways (i.e. coal), Newspapers.

Just like the market always think 5 months ahead, all the billionaires I read about have 5-7 years horizons for their plans in the form of buying and selling assets ... that is what killed GE's shareholders... lack of focus on thinking on what would happen in 2012 back in 2006. Instead they hope to grow the business, to increase the dividend and other nonsense...... the older generation would have bailed on the finance arm way before it took over the shop... meantime real estate looks like the play in 2012!

THE TRICKY PART: American Industry must now embark on a "peace" dividend and spend it on infrastructure and technology but they are held back by, of all things. the health care bill was meant to fix the costs of labor along a viable rate not an exponential curve. CEOs might be scratching their heads on trying to grow their top line revenue for the next shareholders meeting but if they really were any good at their jobs they would TRY to fix health care

Why trust the US as a place of business when health care costs and litigation derail business decisions in favor of China, Brazil? or anywhere for that matter? Any businessman worth his stock options will tell you: " not a good idea to go into a 5 year program where government rhetoric can impede rather than help minimize let alone quantify risk.

I believe it is a mistake on the part of the Republicans to partisan the debate and block health care reform... the sooner it passes the beter the dividend by the time they come to power in 2012. By 2015 you will read biographies where Republican congressional leaders will look back at 2009 and say THAT was the time to pass legislation. Now money talks in Washington not intelligent debate.

In the meantime, next week the ever frequent US Treasuries notes auction is coming to gauge the market appetite. Let's hope the Wall Street fat cats don't use the opportunity to show their displeasure with the Obama tactics to feed them to popular anger...

Now you may be asking yourselves , been reading this rant for 5 minutes, where is Bernanke in all of this? He 's the desert my friends! With a stalling reappointment vote

delayed in Congress, he may become the poor sacrificial goat to appease all the disgruntled. Quite unlikely for TIME's man of the year but HOW much fun it is to think of all the possible candidates... A good and true disciple of von Mises would be too much to ask for but I'd rather fall asleep on the thought of an appointment of an Austrian school economist rather than those awful choices rampant these days!

Enjoy your weekend and hope you have some cash stashed aside ... you might need it sooner than you think!

Thursday, January 7, 2010

Inflation...

We were warned. Printing money is a short term solution. Bernanke and Geithner were the men of the hour if not the year in 2009 but like all heroes, time to let real fixers come in and do the dirty work.

We've said it many times, the US economy is broken. A political class that is easily if not cheaply bought to the detriment of the average Joe cannot expect to fix itself. 2 senators are leaving the scenes but many other guns for hire are up to squandering fiat currency.

It is a shame that Wall Street continues to be bailed out when the problem will just continue to grow in proportion to the accumulated debts of the USA.

Now with a $14 TB debt load, aging baby boomers sucking out the life of public healthcare and 15MM people out of jobs, the printing presses are furiously running out of ink.

2-10 yr spread on Treasuries is at its widest point in 20 years showing that the Fed has drawn a line in the sand and who ever crosses it is betting against the Fed. Usually not a good move but this time, is it Different?

In the last month, we can sense that the Treasury department 's alarms bells are going off.

Around the World China, Vietnam, Australia have started to raise rates to keep their customers happy, why are the Americans late to the game?

This does not bode well for the US dollar as the powers that be are not inclined to protect the dollar.

Continue to hold gold, buy some more gold if not hoard the sucker!

Until Long term rates cover inflation, there is no better asset to hold.

Good trading to you!

DCW

We've said it many times, the US economy is broken. A political class that is easily if not cheaply bought to the detriment of the average Joe cannot expect to fix itself. 2 senators are leaving the scenes but many other guns for hire are up to squandering fiat currency.

It is a shame that Wall Street continues to be bailed out when the problem will just continue to grow in proportion to the accumulated debts of the USA.

The Fed is buying $1.25 trillion of mortgage-backed securities issued by housing-finance companies Fannie Mae, Freddie Mac and federal agency Ginnie Mae. The central bank began the program in January 2009.

The central bank separately purchased $300 billion of Treasury securities from March through September 2009 and is buying, through March, $175 billion of corporate debt issued by government-backed Fannie and Freddie and the government- chartered Federal Home Loan Banks.

Now with a $14 TB debt load, aging baby boomers sucking out the life of public healthcare and 15MM people out of jobs, the printing presses are furiously running out of ink.

2-10 yr spread on Treasuries is at its widest point in 20 years showing that the Fed has drawn a line in the sand and who ever crosses it is betting against the Fed. Usually not a good move but this time, is it Different?

In the last month, we can sense that the Treasury department 's alarms bells are going off.

Around the World China, Vietnam, Australia have started to raise rates to keep their customers happy, why are the Americans late to the game?

This does not bode well for the US dollar as the powers that be are not inclined to protect the dollar.

Continue to hold gold, buy some more gold if not hoard the sucker!

Until Long term rates cover inflation, there is no better asset to hold.

Good trading to you!

DCW

Subscribe to:

Posts (Atom)

History shows us that nations that prospered to the top of the economic pyramid were those that had more benefits from comparative advantage of production methods, strong savings ethics, fostering an environment where education, innovation, entrepreneurship backed by solid development of intellectual property were the order of the day.

Right now the US economy has a monkey on its back where 20% of its economy is controlled by bankers when 7% would suffice PLENTY. Too many banks, too much capital tied to banks rather than flowing into the system of production and exports. The Federal reserve since the last nomination of Greenspan has perpetuated this travesty and exacerbates the problem with subsidized low rates and a conspiracy to protect Wall Street to the detriment of the public.

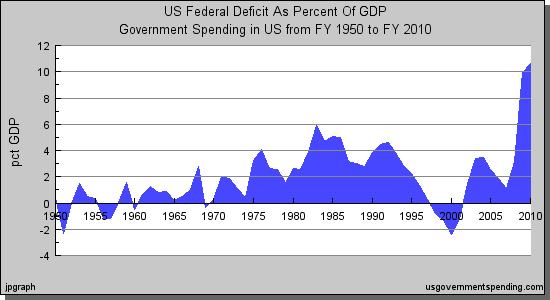

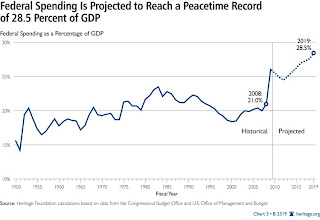

Instead now you have a whinny, socialist propaganda appealing to an unqualified electorate benefiting from handouts. As the same time, the establishment ( Banks, Pentagon and entitlement programs) continue to be propped up by soaring deficits, unfathomable debt loads and the most expensive health care in the world. Class warfare is growing and iniquity in the American society is trending down for the middle class. The only undeniable number one position that the US can flaunt is its title of the most litigious nation in the world.

WHEN is enough, enough?

In the State of the Union address, President Obama should get the message out that the US government is not Santa Claus. That people and corporations have to take responsibility for their follies of years past.

If I were to write that speech and most importantly not have to deliver it to a hostile crowd, this is what I would say

After the preliminaries , I would engage the audience with this:

"BUT WHAT IS REALLY THE STATE OF THE UNION?

1)The US economy is on its last leg as the freest and largest consumer economy in the world. It is transitioning back to an exporter of often raw materials which do not need skilled workers.

2) Congressional elections remain a sham. Nominations go the well connected and victories remain with the deepest pockets.

3) The office of the president is pretty much useless vs. the power yielded by Congress and the Supreme court. So help me out here, what can I do to get re-elected?

4) Things don't look very bright and the recovery for middle America is tedious at best.

5) While it might make the people feel good to be courted by promises of change, listening to candidates battle out it every two years for two years, the office of the President is a Hollywood prop up piece. It's the PR department of the Pentagon. It shows off nice toys like Air Force One. It is a reactionary office dealing with threats and crises. Sometimes I get to float programs but always at the expense of the taxpayer

6)The cabinet is usually made of very bright and accomplished people but their opinions and lasting legacies are few and usually very short lasting.

7) Foreign policy initiatives with touring secretaries of State walking like Darth Vader traveling to trouble spots and UN booze bashes are OK and we have to continue healing wounds.

WHAT WE HAVE TO LOOK FORWARD TO

As an administration we want to start with a simple agenda:

1) Promise of fair taxation

2) Simplified tax code

3) Programs to encourage savings

4) Private investment initiatives

5) A strong dollar policy to make debtors accountable

6) Once we balance our books, we will propose legislation for health care reform"

This would do more than all this useless pork barrel deficit spending run by a bunch of clueless academics , economists and other charlatans.

LIKELY OUTCOME

There was no recovery in late 2009. Just depleted inventories. Unemployment is going up this year to 10.5% and then up from there. From 2010 to 2014, the western world will be dealing with a depression and sovereign debt default.. 4 years of blaming the government, a lot of soul searching and then in 2015 a rebirth with outrageous inflation...Exporters' currencies will rise, importers will fall.

Not a pretty outcome... thank you Mr. Greenspan for getting the world hooked on subsidized rates

CONCLUSION

Mr. American voter, you should have let your government know that Volcker policies would keep you safe. The Clinton administration and Congress' push of the repeal of the Glass Stegall act fights with the Bush 43's invasion of Iraq as the worst blunders of the American government since WWII.

You continuously vote out of office politicians who come up with balanced budgets.

Now it is very hard to go rehab and clean up your act!

Good Night and god bless everyone who has to deal with the consequences of American policy. i.e. the American voter

Good trading to all!